how are property taxes calculated at closing in florida

Closing costs are a collection of fees dues services and taxes that are split between the buyers and sellers of real estate property and cover the additional expenses. Closing Fee The title company assesses this fee for their role in closing the.

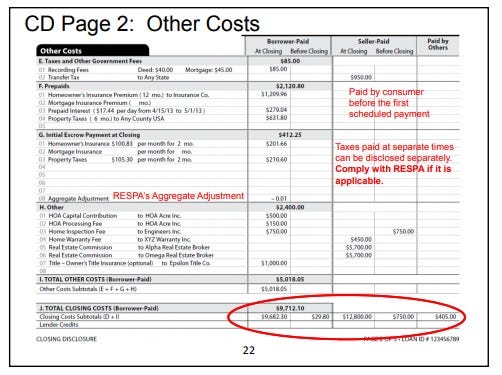

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

We dont know what the property taxes for 2021 will be until November.

. 16291 Sarasota County Fire Rescue a Non-Ad Valorem assessment 428066. The real estate taxes for Property B are equal to 2000001000 x 215570 431140. Knowing how to calculate your property tax expense is important in knowing whether you can afford a particular home.

Sellers Closing Cost Calculator. It frees the first 25000 of the homes assessed value from all property taxes and it exempts another 25000 from non-school property taxes. What are closings costs.

The report goes on to state that counties in Florida collect an average of 097 of a propertys assessed fair market. How much are closing costs in Florida. Youll pay around 16 of your homes final sale price in seller closing costs when you sell a home in Florida.

Tax amount varies by county. Real Estate Agent Commission typically 5-6 of the sales price. Everywhere in Florida outside of Miami-Dade County its calculated at 60.

Heres how to calculate property taxes for the seller and buyer at closing. How Are Real Estate Taxes Prorated At the Closing. 097 of home value.

Florida currently ranks number 23 for the amount of property taxes collected. Divide the total annual amount due by 12 months to get a monthly amount due. Though all the taxes fees lender charges and insurance add up generally neither party pays 100 of all the closing costs.

If you buy a property in that range expect to pay between 7740 and 10320 in. To calculate the property tax use the following steps. This can get confusing so heres an example.

Buyers Title Insurance Cost and Closing Costs Itemized. The actual amount of the taxes is 477965. Plus the state is still ranked as the 23rd in the nation in terms of the average amount of property taxes collected.

Say Bob Burns is buying a home from Ted Smith the closing date is September 1st 2021 and the property taxes were 3500 in 2020. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. The actual amount of the taxes is 477965.

Ted owned the house for 8 out of 12 months. The taxes are assessed on a calendar year from Jan through Dec 365 days. The average property tax in Florida is an annual 173300 considering a home.

Taxable Value X Millage Rate Total Tax Liability For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead. In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on the deed. Closing costs in Florida are on average 4606 for a home priced at 255006 according to a 2021 report by ClosingCorp which provides research on the US.

Across the state the average home sells for somewhere between 300000 and 400000. Buyers Closing Cost Calculator. For a 378104 home the median home value in Florida youd.

Closing Cost and Sellers Net-Sheet Calculator. 4200 12 350 per month. So Ted seller will pay Bob buyer a prorated credit for taxes based on last years amount.

Lenders Title Insurance The buyer also provides the mortgage lender with a title insurance policy. Since the closing date does not line. Lets look at the 2015 Ad Valorem taxes in detail.

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Your Guide To Prorated Taxes In A Real Estate Transaction

The Buyers Guide To Closing Costs Florida Realtors Home Buying Checklist Home Buying Real Estate Buyers

Deducting Property Taxes H R Block

Understanding Property Taxes At Closing American Family Insurance

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

What Should Homebuyers Ask Themselves Before Entering The Market Real Estate Buyers Home Buying Real Estate Buying

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Boxes Easy

Property Tax Prorations Case Escrow

Helpful Tips To A First Time Home Buyer From A First Time Buyer Buying First Home First Home Buyer Real Estate Infographic

Buyers Don T Be Surprised By Closing Cost Real Estate Fun Real Estate Infographic Real Estate Advice

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Hav Title Insurance Title Things To Know

Closing Costs That Are And Aren T Tax Deductible Lendingtree

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)